September 24, 2025

Market Watch: Are We Dancing on a Volcano?

In our last post, we touched upon the uncertain economic climate. This week, the plot thickens. While markets might seem placid on the surface, beneath the calm waters, dangerous undercurrents are swirling. The recent decision by the FED to cut rates by 25bps, with hints of more to come, was met with a shrug by many, but it feels less like a proactive measure and more like a quiet admission of weakness.

I. The Overvaluation Alarm Bell

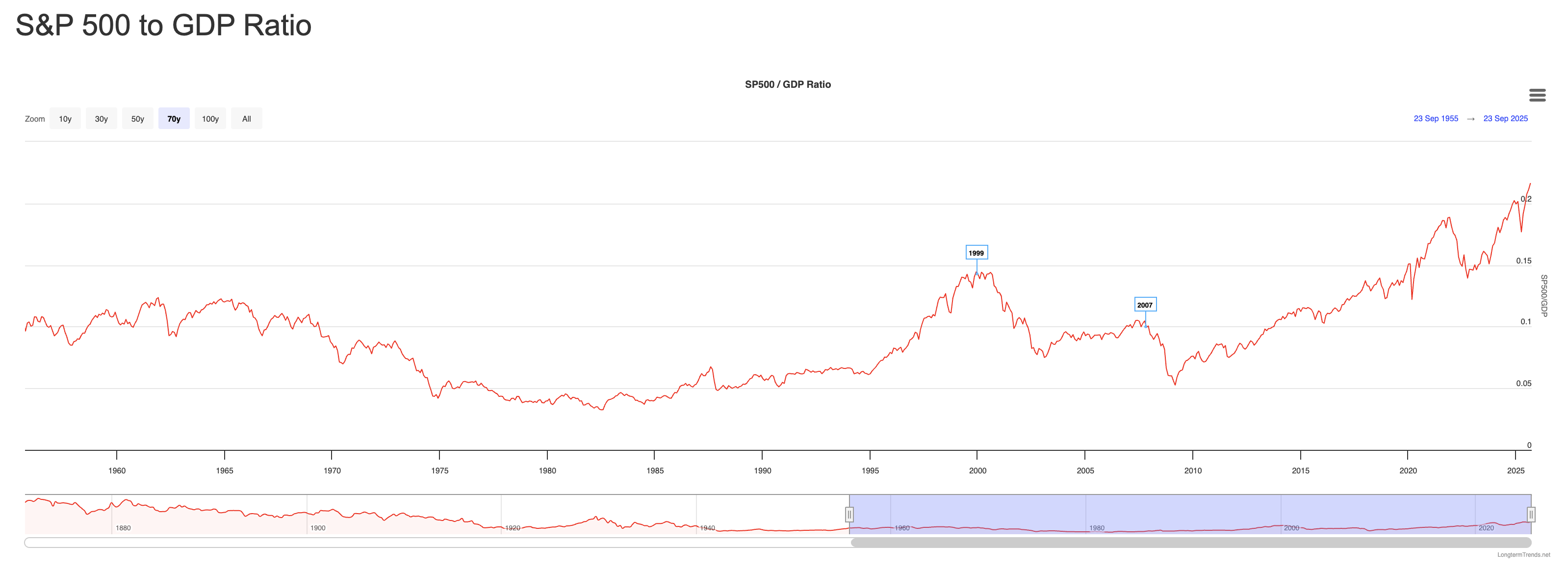

Let's talk about valuation. A time-tested metric for gauging market temperature is the ratio of the stock market's total value to the nation's GDP. While the "Buffett Indicator" is the most famous version, looking specifically at the S&P 500 relative to US GDP gives us a clear picture of where the giants of the market stand. And the picture is alarming.

Figure 1: S&P 500 to GDP Ratio. Source: Longtermtrends.net

As the chart shows, the current ratio has soared past the levels seen during the dot-com bubble of 1999-2000. We are in uncharted territory. The general consensus is no longer a whisper but a roar: the market is fundamentally overvalued. The real economy, represented by GDP, simply isn't growing fast enough to justify these equity prices.

II. Follow the Smart Money (Out the Door)

If you want to know what's really happening, don't listen to the talking heads; watch what the insiders are doing. Corporate executives and major shareholders have been unloading their shares at a record pace. In the last 30 days, a staggering 95% of all insider transactions have been sells.

Contrast this with the retail crowd. Since August, retail investors have been piling into the market, with inflows hitting their highest levels in over a year. This is a classic, textbook divergence. The "smart money" is quietly exiting stage left, while the "dumb money," fueled by FOMO, is rushing to buy their tickets for a show that might be about to end.

III. The Tech Illusion and a Crypto Canary

The tech sector, particularly AI, has been the engine of this bull run. But some of the growth looks suspiciously artificial. Take the case of Nvidia and OpenAI. Nvidia invests billions in OpenAI, which then uses that capital to purchase chips from... Nvidia. This creates a closed loop of "revenue" that looks fantastic on a balance sheet but doesn't represent genuine, broad-based economic demand. It's an accounting trick, and it's the same kind of sleight of hand we saw just before the dot-com bubble burst.

If you need a more immediate warning, look at the crypto markets. This week, Bitcoin suddenly dropped 4%, triggering the largest wave of liquidations seen all year. It was a brutal, swift reminder of how much leverage is propping up asset prices. When the tide goes out, we'll see who has been swimming naked, and crypto just gave us a taste of what's to come.

The signs are all there for those willing to see them. Extreme valuations, insider selling, artificial growth, and fragility in speculative assets. The market is dancing on a volcano, and it feels like the ground is starting to shake.